Chris Lester, Associate

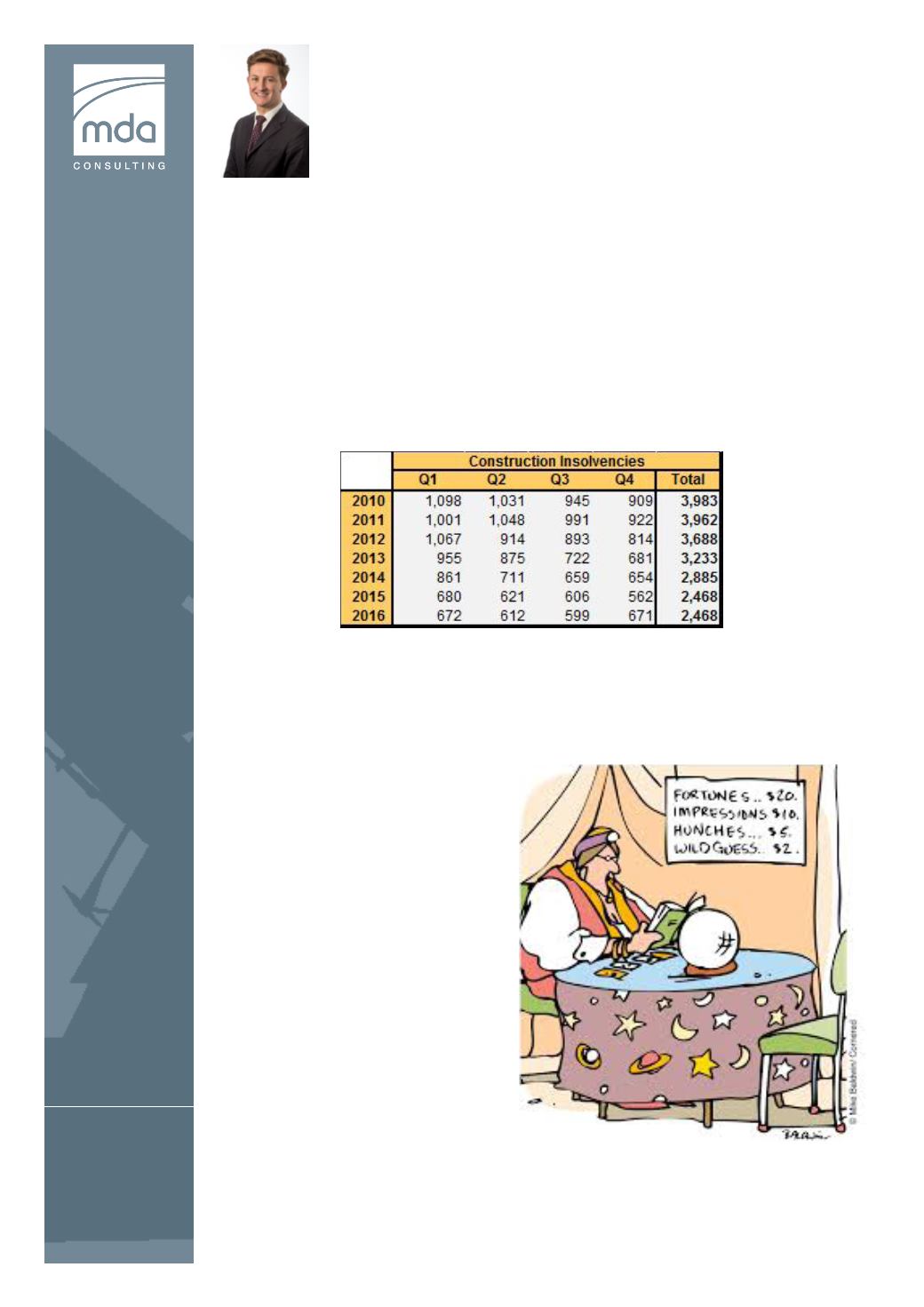

The latest figures presented by the Insolvency Service show that in the 12 months

ending Q4 2016, the level of construction related insolvencies was the same as the

previous 12 months (to Q4 2015), which is the first time the number of insolvencies

has not declined (year on year) since 2010. The table below provides an overview

of the insolvency figures. Statistics are presented with a lag of a quarter, allowing

time for more complete data to be collected by industry. We eagerly await the latest

figures for the period Q1 2017. Nevertheless, the latest figures published, indicate that

construction related insolvencies increased for the first time between Q3 and Q4, which

was the first quarterly rise between Q1 and Q4 in any year, since before 2010. The

construction industry often reflects the health of the economy and when the industry is

doing well, the country and economy as a whole is doing well with fewer insolvencies.

Figures taken from Insolvency Service

Interest rates fell to 0.5% in April 2009, with a more recent reduction of 0.25% in August

2016 to an historic all-time low. This is likely to have been one of the key factors to have

contributed to the declining levels of construction insolvencies, with so called ‘zombie

companies’ being able to cover debt

repayments, along with, of course,

an increase in opportunities within

the sector given the overall strong

economy. The length of time that

interest rates have been at such

a low level, will have also enabled

companies to restructure internally,

allowing them to benefit long term.

However, the uncertainty over Brexit

will have raised concerns on whether

this will have a significant negative

effect on the construction industry.

Construction output has not been

as strong over the last 18 months

and experts have cited government

spending cuts and changes to

private sector investment plans

(post-referendum) as likely reasons.

The outcome of the Government’s

negotiations post-triggering of Article 50, remains to be seen, though given its

protracted nature some businesses are expected to postpone commitments to major

capital expenditure until details are better known.

CONSTRUCTION INSOLVENCY